Core Banking Features

-

Inter Branch Connectivity

-

Finger Print Biometrics

-

Receipt Printing

-

SMS Banking

-

Mobile Banking

-

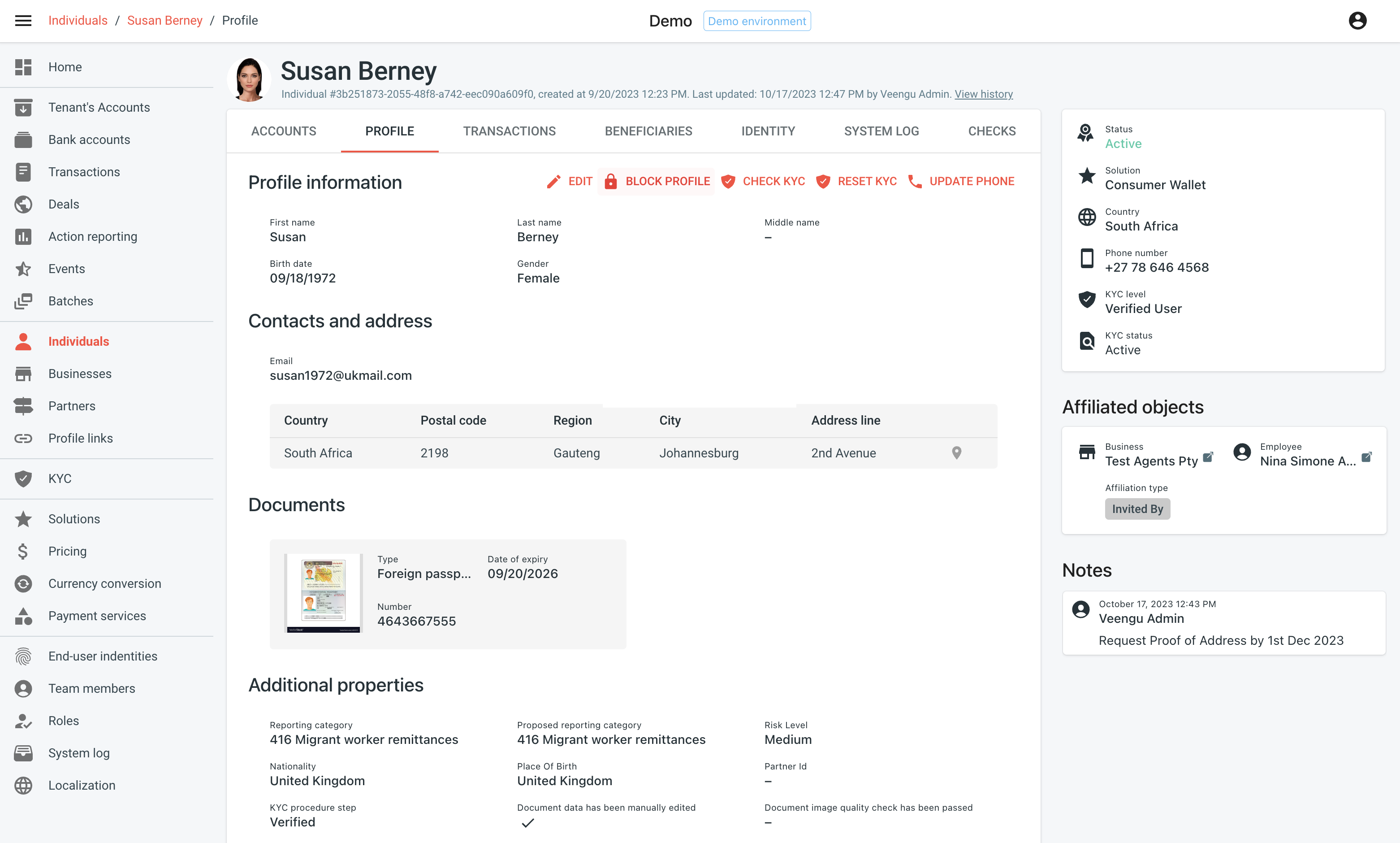

Customer Management

-

Integrated General Ledger and Financial Management

-

Advanced Reporting and Business Intelligence

-

Savings Management

-

Shares Management

-

Loans Management

-

Fixed Deposits and Overdrafts Management

-

Users Management

-

HRM Module

Core Operations Features

- Automatic Inter-branch Reconciliation

- Real Time Transaction Processing

- Real time generation of ALL reports including bank/branch balance sheet

- Balance sheet is available before day end.

- Centralized day end of all branches

- Core Accounting Software: Regular Company Accounting, Asset Management with Depreciation.

- Treasury (Front Office / Middle Office / Back Office): Investments, Borrowings.

- HR: Payroll.

- Inventory and Fixed Asset Module & Depreciation

- Legal & Recovery

- Budgeting

- Microfinace Module

- Group Management

- Group Loans

- Group Collection

- Loan and Security Account Linkage

- Sinking Fund

- Interest Free Period

- Flat/Reducing/Amortization Interest Setup

- Agent Based Payment and Collection

- Banking

- CASA (Current and Savings Accounts) Module

- FD/RD (Fixed Deposit and Recurring Deposit) Module

- Loans Module

- Loan Origination Software

- Bill Purchase Module

- Remittances Module

- Clearing Module

- Lockers Module

- SI (Standing Instructions) Module

- NPA (Non Performing Assets) Module

- ALM (Assets Liability Module) Module

- Trade Finance (including LC/BG)

- Report Generator

- Printing Module

- Risk Management

- Document / Signature Linking

- Bill Collection (Inward & Outward)

- Payment Gateway

- RTGS/NEFT (Real Time Gross Settlement and National Electronics Funds Transfer)

- ATM (Automatic Teller Machines)

- SMS (Short Message Service) Banking

- Mobile Banking

- IMPS (Immediate Payment Service)

- Internet Banking

- ECS (Electronic Clearing House)

- ACH (Automated Clearing House)

- CTS (Cheque Truncation System)

- ATM

- Card Management

- Health Check Dashboard

- ATM Cash Management Software

- ATM Front End Software

- Passbook Printing

- FD Printing

- Cash Dispenser

- Passbook Kiosk

- Microfinance Hand Held Device Integration

- Anti Money Laundering (with KYC (Know Your Customer))

- Service Branch Clearing

- Cash Pooling

- Currency Chest

- FOREX & Cash Denomination Management

- Cashier Management

Security Features

Efluxcore prioritizes the highest level of data and transaction security:

- Audit Trails: Audit trail of each transaction in the system is kept with date, time and user-id stamp.

- 3DES Encryption: All data between a device and the backend is transmitted after encrypting it with industry standard 3DES encryption. This prevents any snoopers to sniff the channel and get financial data information.

- User Access Encryption: All passwords are kept using industry standard RSA encryption. This prevents the administrator from knowing the passwords of any user.

- Data Security: Data is kept secure using database login and password.

- Access Security:

By Role and Rights explained more in Administration Features.

- Login user control

- Remote log-in control

- Menu and screen locks

- Time based user login

- Automatic logout after predefined time

- Login name/date/time/activity/tracking

- Secured Transaction Security Features

- Detailed transaction and error logs generation

- Product Based User/Transaction control

- Amount Based Transactions control on users

- Confirmation of all transactions by higher authority

- Dual authorization for specific transactions

- Database security ensured by data encryption

- Provision of back log entry

Administration Features

Efluxcore offers comprehensive administrative control and flexibility:

- Integrated Delivery Channels: Fully integrated with a variety of delivery channels such as Internet Banking, Mobile Banking, Email Alerts, Touch Screen Kiosks and IVR systems.

- Product Definition: Highest possible level of parameterization available.

- Interest Definition: High level of parameterization available.

- Masters, Control Values and other Parameters: High level of parameterization available.

- Service Outlet Concept: Each branch or delivery channel is designated as a service outlet and each transaction can be tracked at a service outlet level.

- Maker Checker Concept: Allows the bank to have double or triple checks in place by having one person make an entry, another to verify it and sometimes if necessary a third to re-verify or enable it.

- ApiConnect: Allows the bank to provide financial transaction access to third-party solutions such as ATMs and Credit Card Institutes such as MasterCard and Visa.

- Multi Lingual

- Roles and Rights: A bank can create various roles (designations) based on its Organization Chart and associate view, create, modify and delete rights on each screen as well as access to the screen itself.